October Real Estate A.G.E.N.T. Survey Some Storm Recovery but Traffic Broadly Subsides Elsewhere

Traffic Flat in October: Our Buyer Traffic Index was approximately flat at 38 in October, indicating trends remained below agents’ seasonal expectations. Hurricane-affected markets across Florida exhibited lingering storm impacts but bounced back sequentially, with the FL average traffic index rising to 41 from 25 last month. Houston remained depressed, with a buyer traffic index of 28, given the greater damage levels. The rest of the markets we track declined further on average, with the top-40 traffic index ex-FL/Houston falling to 37 from 41. The broad-based inventory shortage was by far the most cited reason behind decelerating traffic levels, compounded by the resulting worsening affordability. Pricing still broadly continued to push higher, although a few markets began to see price adjustments in response to deteriorating traffic, a trend we will continue to watch. By price segment, entry-level and move-up buyers saw declining trends but were still viewed more favorably than .

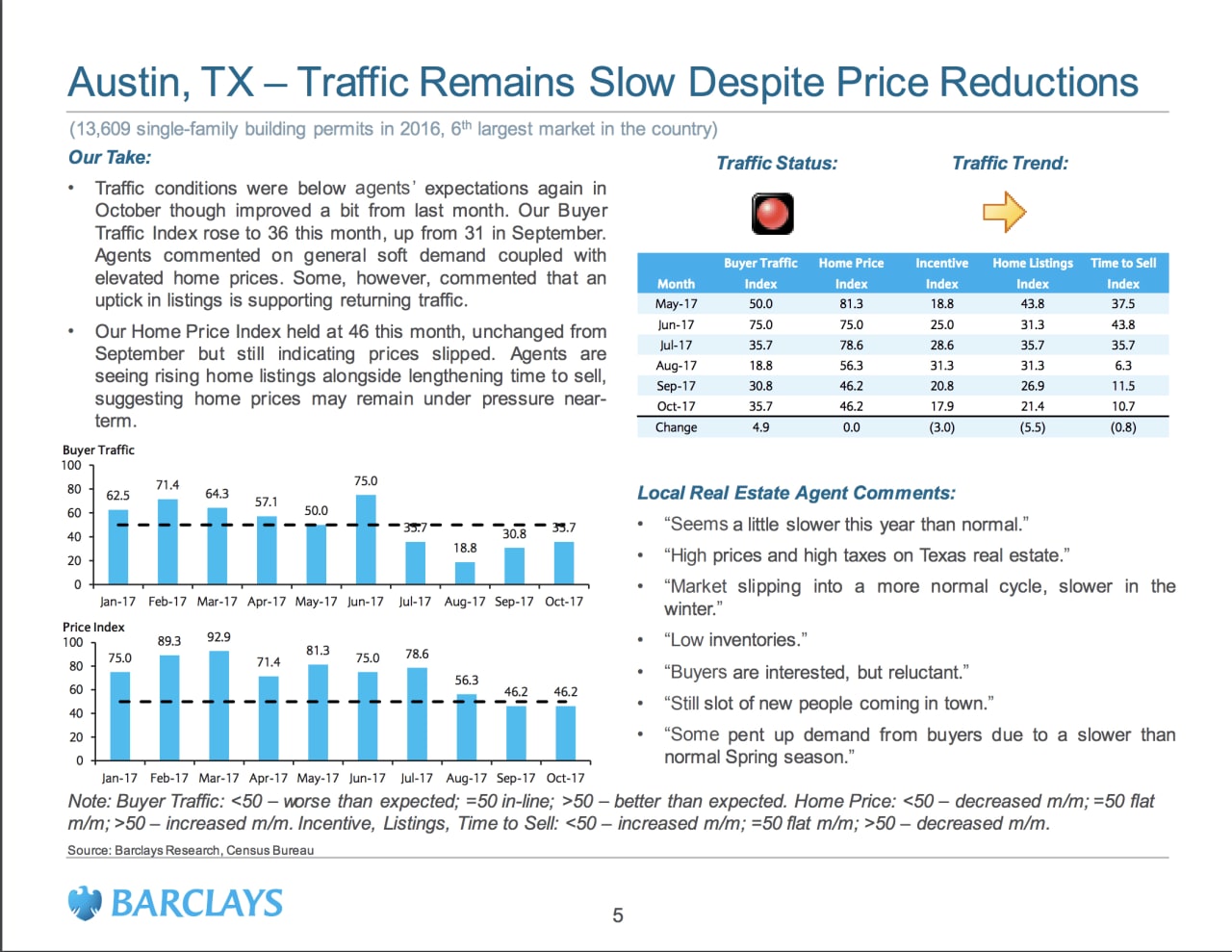

Off markets miss expectations: In October, only 2 of the 40 markets we survey saw better-than-expected traffic (3 in September), 8 saw traffic in-line (11 in Sept.), and 30 pointed to lower-than-expected traffic (26 in Sept.). Texas (Houston, San Antonio) and the Pacific Northwest (Portland, Seattle) the weakest regions. New York, D.C., Baltimore, and Chicago were other notable laggards. Florida remained below expectations but also saw the strongest sequential improvement post Irma in September. Other Southeast markets showed improvement as well. California markets slipped sequentially but remained above-average, as did the Southwest (Phoenix, Vegas).

Breadth of price increases narrows: Our Home Price Index came in at 62 in October, unchanged from September. Of the 40 markets we survey, 27 saw higher prices m/m in October (28 in September), 9 markets experienced flat prices (9 in September), and 4 markets saw lower prices m/m (3 in September). The strongest price readings were seen in Virginia Beach, Kansas City, Las Vegas, Cincinnati, and Sarasota. Sequentially lower prices were seen in Nashville, Baltimore, Columbus, and Washington DC.